WTI Oil – narrow consolidation likely to precede fresh push higher

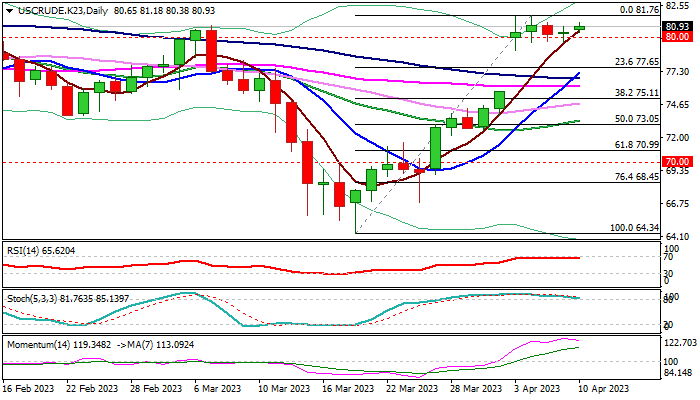

WTI oil price is holding in extended consolidation within $80.00/$81.00 range for the fifth straight day, after last Monday’s opening with gap higher of nearly 6%.

Bulls continue to hold strong gains, sparked by surprise decision by OPEC+ group to further cut production, which so far fully offset demand concerns on persisting recession warnings.

Holiday lowered volumes keep the action within a tight range, but the price holds recent gains and consolidating just under new multi-week high that continue to fuel positive environment and boost expectations for further advance.

Broken $80 barrier reverted to strong support which contained several attacks last week, keeping immediate bulls intact for probe through new top at $81.76 and extension towards significant barriers at $82.64 (2023 high) and $83.42 (falling 200DMA).

On the other hand, overextended daily studies suggest that price may hold in extended consolidation or enter correction, in case that $80 support is lost.

Bulls are expected to remain in play as long as last week’s gap is unfilled, with extended dips to be contained by rising 10DMA ($77.21).

Res: 81.21; 81.76; 82.64; 83.32

Sup: 80.00; 79.62; 78.98; 77.65