WTI oil price rises to four-month high on supply concerns

WTI oil rose further on Wednesday (in extension of Tuesday’s 2.9% advance) and hit the highest in four months ($63.50).

Weakening dollar, disrupted US crude output due to heavy winter storm which halted production and recent outages from Kazakhstan supplies after Ukrainian drone attack, were mainly behind the latest acceleration, while market participants closely monitor developments in the Middle East, following latest threats of US attack on Iran.

In the worst scenario of conflict escalation, Iran may close the Hormuz straight and cause panic reaction in the market that would make oil prices skyrocketing.

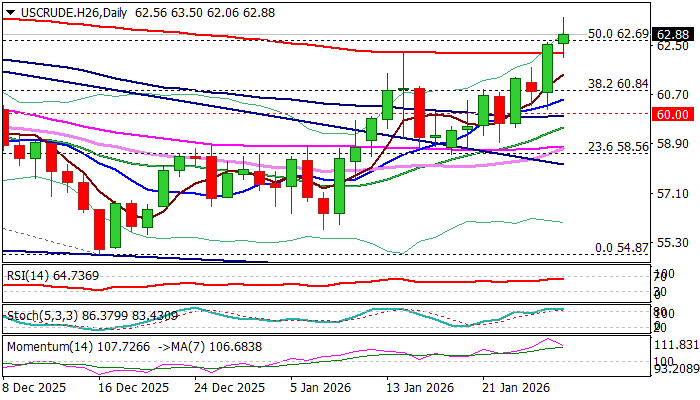

The latest rally broke significant barriers at $62.18 (200DMA) and $62.69 (50% retracement of $70.50/$54.87) with close above needed to verify bullish signal and open way for further upside ($64.53, Fibo 61.8% retracement marks next significant barrier).

Meanwhile, bulls may take a breather for consolidation as Stochastic is overbought and positive momentum starts to fade.

Broken 200DMA reverted to solid support which should ideally hold, though deeper correction cannot be ruled out, with $61.02/$60.84 (rising daily Tenkan-sen / broken Fibo 38.2%) expected to hold and keep bulls in play.

Significant rise in oil prices in January (nearly 10%) leaves long bullish candle and contributes to formation of reversal pattern (still in early stage) on monthly chart.

Res: 63.50; 64.00; 64.53; 65.00

Sup: 62.18; 61.45; 61.02; 60.84