WTI Oil regains levels above $60 as signals of US-China trade talks ease tensions

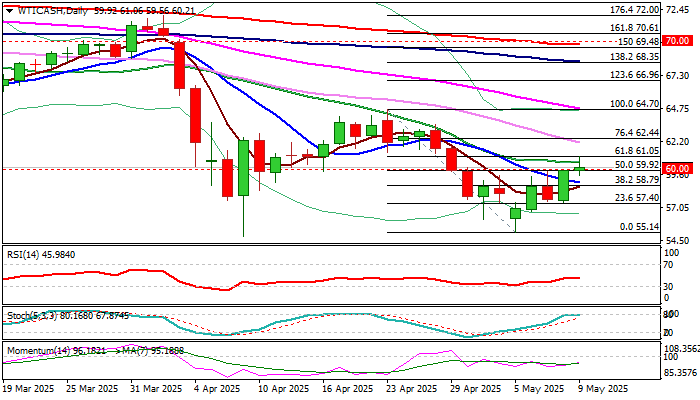

WTI oil keeps firm tone and attempts to hold gains above pivotal $60 barrier (psychological / Fibo 50% retracement of $64.70/$55.14 bear-leg).

The price rose around 4% on Thursday, inflated by fresh optimism after US and China announced start of trade talks over the weekend.

The contract is also on track for the weekly gain of slightly over 7% (the biggest weekly advance since the last week of September 2024).

Easing fears of potential escalation of trade conflict between two world’s biggest oil consumers brightened demand outlook and partially offset threats of oversupply after the OPEC+ announced the third consecutive output increase from June 1 (total of 960K bpd).

Thursday’s strong rally which broke above psychological $60 resistance and cracked $61.05 (Fibo 61.8% generated initial bullish signal, although technical picture on daily chart is still lacking firmer signals as studies are mixed.

We look for weekly close above $60 to keep near-term action biased higher, with violation of $61.05 to confirm bullish signal.

Meanwhile, the action is likely to remain quiet and await news from US-China talks for direction signals.

Res: 61.05; 61.79; 62.09; 62.44

Sup: 59.92; 58.98; 58.69; 57.40