WTI oil – tightening supply continues to underpin the price

WTI oil edged higher on Friday and holding near the ceiling of near-term range, but still without a clear direction.

Signals that oil supplies are tightening, primarily due to the latest decisions of OPEC+ main members, Russia and Saudi Arabia to further cut production and support oil market.

The price was also supported by record imports of Russian oil by China and India, although analysts fear that buying interest from India is going to weaken that would partially offset recent positive signals and limit oil’s gains.

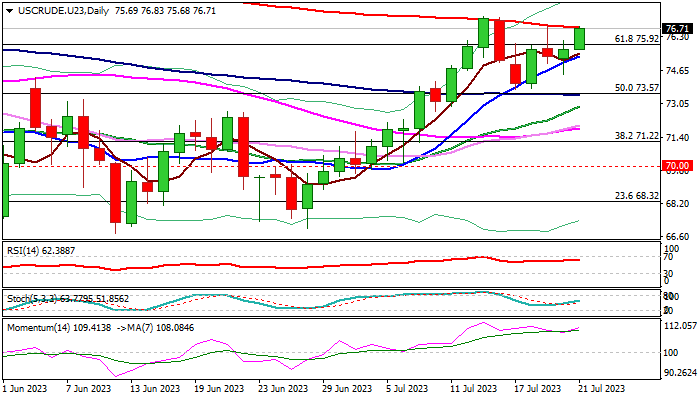

Technical picture on daily chart remains bullish overall, as positive momentum is strong and daily Tenkan-sen / Kijun-sen lines are in bullish configuration, though near-term action was repeatedly capped by falling 200DMA, which reinforces range ceiling and keeps bulls in check.

Near-term action is expected to remain biased higher while holding above rising 10DMA ($75.34), though risk of stall to remain as long as 200DMA caps

We look for initial bullish signal on weekly close above $75.92 (Fibo 61.8% of $83.51/$63.63 descend) which will need confirmation on eventual break through 200DMA ($76.74) and recent tops at $77.30, to signal bullish continuation and expose targets at $78.82 (Fibo 76.4%) and $80.00 (psychological) in extension.

Extended sideways mode could be expected on price action moving between converging 10DMA and 200DMA, while initial bearish signal will be generated on firm break of 10DMA pivot.

Res: 76.74; 77.31; 77.90; 78.82

Sup: 75.92; 75.34; 74.50; 73.81