WTI Oil – wild swings in highly volatile market

The WTI crude oil price fell sharply and recovered quickly, in a wild swings in highly volatile trading on Monday.

The sentiment was strongly hurt by the collapse of Silicon Valley Bank, as fears that crisis in the banking sector may deepen and possibly spread that would shake entire economy.

Oil price fell from European high at $77.14 to the session low $72.28, but swiftly recovered the most of today’s drop, on existing optimism on signs of strong recovery in Chinese demand that partially offset the strong negative impact.

However, investors remain concerned about growing risks in financial markets, after interest rates were raised strongly within short period and hit the weakest points, threatening to deteriorate on further policy tightening, as conditions are already fragile.

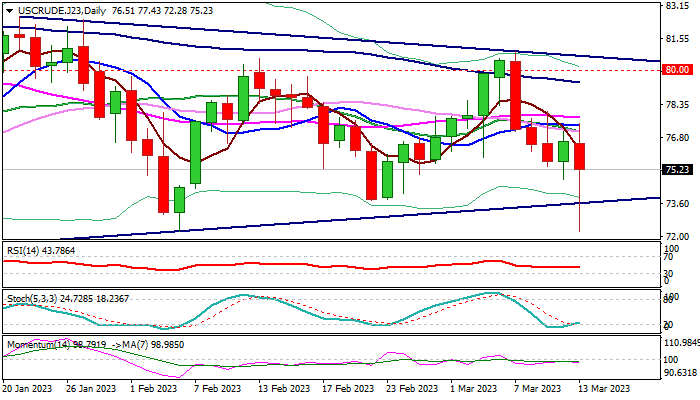

Outlook on daily chart remains negative, despite today’s quick recovery, as negative momentum started to strengthen again and moving averages remain in full bearish setup, threatening of fresh weakness.

In addition, probe below the support line of the wedge pattern on daily chart, also signals that bears are gaining traction for eventual break out of the recent narrowing congestion, to resume larger downtrend

Close below the wedge pattern support line ($73.50) would generate initial signal, which will look for a verification on break of Feb 6 low ($72.24), as today’s fall stalled just few ticks ahead of this support.

Near-term bias is expected to remain with bears as long as the price action stays below the base of thinning daily Ichimoku cloud ($76.70) which capped the action in past few sessions.

Res: 76.70; 77.48; 78.02; 78.87

Sup: 74.75; 73.77; 72.24; 70.00