WTI price moves within narrowing range and looks for fresh direction signals

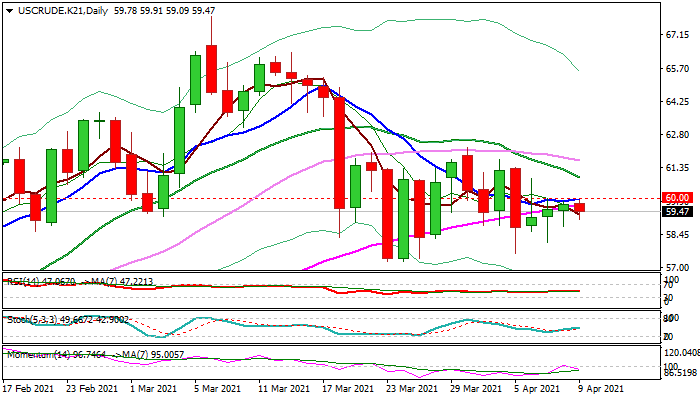

WTI oil price eased on Friday, being capped under psychological $60 level for the fourth straight day, but three consecutive Dojis with long shadows (Tue/Thu) signaled a lack of direction.

Persisting (although reduced) impact of COVID-19 pandemic on global demand and decision of major oil producers (OPEC+) to increase production by two million barrels per day between May and July, continue to weigh on oil prices.

Near-term action is moving within a narrowing range and forming a bearish pennant pattern which threatens of continuation of the downtrend from $67.95 (Mar 8 peak).

Near-term bias is expected to remain with bears while the action stays below $60, but more negative signals (break of pennant support line at $57.82 and Mar 23 low at $57.23) would be required to signal bearish continuation.

On the other side, latest figures that showed draw in US crude stocks point to reviving demand which supports oil prices.

Lift and close above $60 handle would add to positive signals, however, bulls are expected to tighten grip only on sustained break above $62.00.

Res: 60.00; 60.26; 60.95; 61.34

Sup: 59.09; 58.10; 57.82; 57.25