WTI price re-focuses $60 barrier, boosted by strong draw in US crude stocks

WTI oil extends advance on Wednesday and cracks 100DMA resistance ($59.16), maintaining bullish tone on OPEC+ extension of output cut agreement and stronger that expected draw in US crude stockpiles (API report on Tuesday showed drop of 8.1 mln bls, heavily beating forecast for 3.1 mln bls drop and also coming well above previous week’s result of -5 mln bls).

Additional boost to oil price comes from shutdown of production in the Gulf of Mexico in expectations of tropical storm.

Traders focus on EIA crude stocks report, due later today (3 mln bls draw f/c vs previous week’s draw of 1 mln bls) which could further boost oil price if release comes at / above forecast.

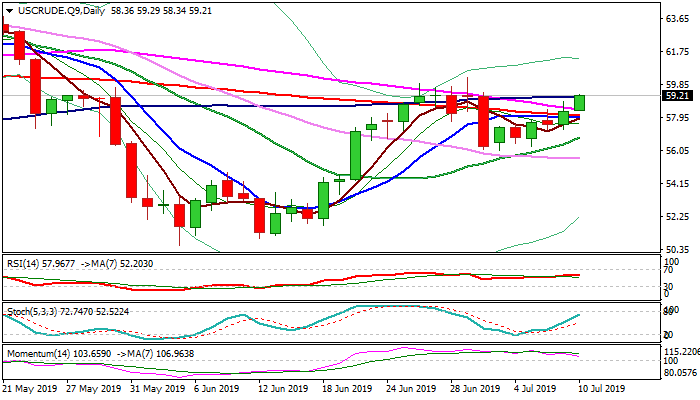

Fresh bulls signal the corrective pullback ($60.27/$56.04) might be over and shift focus towards cracked psychological $60 barrier, which capped last week’s attack (oil price spiked to $60.27, the highest since 23 May).

Bullishly aligned daily techs support scenario, with bullish bias to remain intact while the price holds above broken 200SMA ($58.04).

Res: 59.42; 60.00; 60.27; 60.80

Sup: 58.40; 58.04; 57.90; 57.28