WTI quickly recovered Monday’s heavy losses but the downside remains vulnerable on overall negative fundamentals

WTI oil was firmer in early Tuesday trading following a roller-coaster ride on Monday, when oil fell over 6% and recovered all losses on subsequent quick bounce.

The news that China is imposing fresh package of restrictions on new and strong wave of Covid infections in the capital Beijing and many provinces, soured the sentiment, though for a short period, as traders saw a good opportunity to enter fresh longs at the levels close to 2022 low, posted in early January.

Oil remains very sensitive to fundamentals, which continue to shake oil market almost on a daily basis and seen as a main driver nowadays.

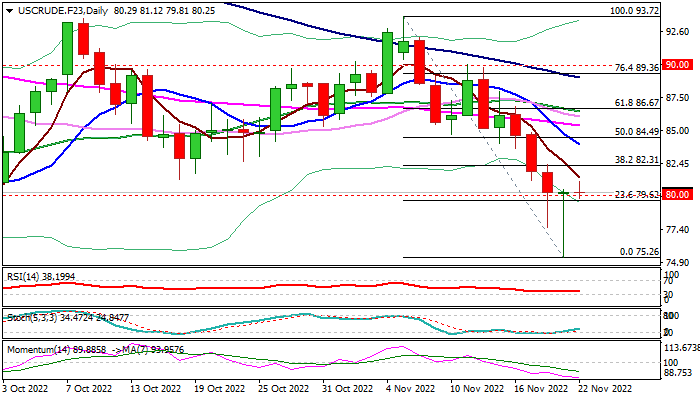

Technical picture is also very interesting, as overall structure is bearish, defined by strong bearish momentum on daily chart and moving averages in full bearish setup.

On the other side, Monday’s strong rejection at key support at $76.25 (Sep 26 low) and also repeated failure to register daily close below psychological $80 support, generate initial positive signal, along with Monday’s long-tailed Doji candle that signaled a bear-trap and Tuesday’s advance, which hint formation of reversal signal on daily chart.

This points to mixed picture, with more evidence needed to confirm signals in both cases.

Bullish scenario requires stronger bounce and firm bullish close today, to complete Doji Morning Star reversal pattern on daily chart, though extension and close above pivotal Fibo resistance at $82.31 (38.2% of $93.72/$75.26) will be needed to confirm and add to fresh bullish bias.

However, this would still keep risk of limited correction of the bear-leg from $93.72 unless stronger acceleration through an array of moving averages and Fibo level at $86.67 (Fibo 61.8%) registers close above these levels.

More likely scenario in which fresh bulls would run out of steam and increase downside risk, is seen in current overall negative environment, boosted by disappointing news from China, which add to existing fears about further slowdown in a global demand as a number of Western economies are already in recession.

Res: 81.29; 82.31; 83.91; 84.49

Sup: 80.00; 79.62; 77.57; 76.25