Directionless mode can extend until FOMC meeting

Fresh easing of the US dollar in early US trading on Monday, obstructs again attempts to eventually break above multi-day congestion.

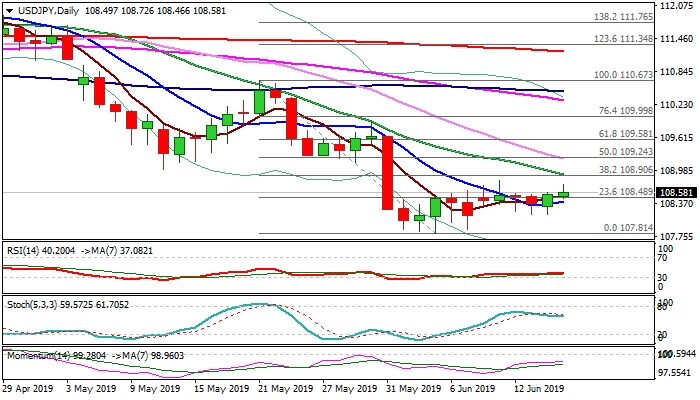

Fresh bulls from last Friday’s rally, which generated positive signal on bullish outside day, are still in play and underpinned by north-heading 10SMA, but lack stronger momentum.

Break above key barrier at 108.90 (Fibo 38.2% of 110.67/107.81, reinforced by falling 20SMA) is needed to generate bullish signal for stronger recovery.

On the other side, 10SMA marks initial support at 108.41, loss of which would weaken near-term structure, with extension below 108.16 (Thu/Fri lows) to shift near-term focus lower.

Directionless mode may extends as markets await signals from FOMC meeting on Wednesday.

Fed is widely expected to keep rates unchanged but dovish shift cannot be ruled out on rising concerns about global growth slowdown.

Res: 108.72; 108.80; 108.90; 109.24

Sup: 108.41; 108.16; 108.00; 107.81