Oil prices hit one-month high on improved demand outlook, further fall in crude stocks

WTI oil is consolidating just under new one-month high ($63.44) on Thursday, following 3.8% advance on Wednesday, the biggest one-day rally since Mar 24.

Improved forecasts for global oil demand by the International Energy Agency and OPEC, on signs that major economies recover from the pandemic, lifted the oil prices, along with revived risk appetite that weakened dollar.

Wednesday’s report from Energy Information Administration showed stronger that expected drop in crude inventories previous week (5.88 mln bls vs forecasted draw of 2.88 mln bls), adding to positive sentiment.

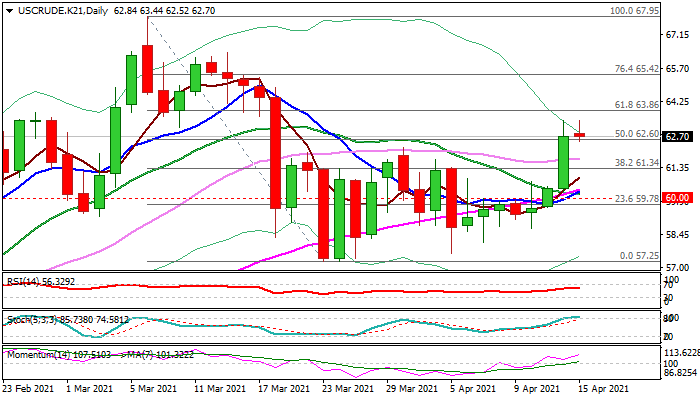

Fresh advance emerged above thick daily cloud and has so far retraced over 50% of $67.95/$57.25 pullback, signaling that corrective phase might be over.

Daily chart studies show moving averages in bullish setup and rising positive momentum that underpins the advance, but overbought stochastic suggests that bulls may pause for consolidation.

Repeated daily close above daily cloud top ($62.48) would signal that bulls remain firmly in play, while failure would allow for shallow pullback which should be ideally contained by broken 30DMA ($61.78).

Res: 63.44; 63.86; 64.85; 65.42

Sup: 62.50; 62.23; 61.78; 61.34