Gold steady near new all-time high as markets await announcement of new US tariffs

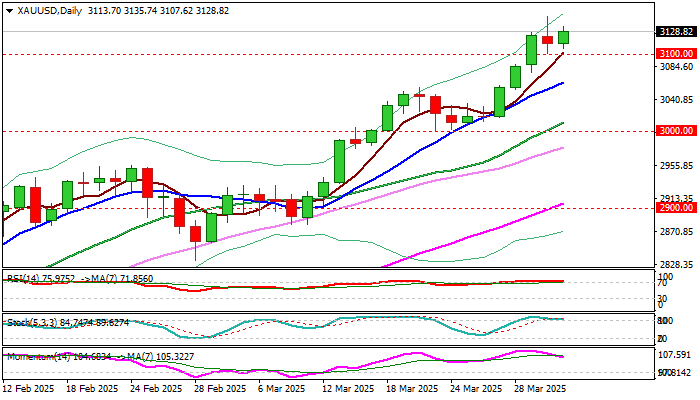

Gold prices remain firm and hold above $3100 for the second consecutive day, after the metal hit new record high at $3149 on Tuesday.

Strong safe haven demand on high economic and geopolitical uncertainties continues to lift gold price, which advanced over $400 since President Trump started his term in the White house.

The yellow metal ended March with over 9% gains that marks the biggest monthly gain since August 2011 and was up over 18% in the first three months of the year.

All eyes are now on President Trump’s announcement of reciprocal tariffs (due today at 20:00 GMT) which is expected to generate strong direction signal.

If Trump decides to act according to his promises during the past few weeks and announce implementation of full package of new tariffs on various countries (in addition to existing tariffs), gold would appreciate further in such scenario.

Violation of immediate barriers at $3149/57 to expose targets at $3171 and $3200, with stronger acceleration higher not ruled if markets anticipate that consequences of escalating trade war will be dramatic.

Additional support to metal’s price would come from worsening situation in Ukraine following warnings of peace talks failure, as well as deteriorating economic conditions in US and EU, following recent discouraging economic data.

On the other hand, softer tariff rhetoric from Trump would ease bullish pressure and probably deflate gold price, though dips likely to be limited as overall picture is still very bullish, with other factors fueling safe haven demand, remaining firmly in play.

Broken $3100 level reverted to initial and solid support, followed by rising 10DMA ($3062), and Fibo 38.2% of $2032/$3149 ($3028), with $3000 level (psychological / higher base) likely to contain extended dips and keep larger bulls in play.

Res: 3149; 3157; 3177; 3200

Sup: 3108; 3100; 3062; 3028