Nasdaq – bears are taking a breather after almost 10% loss last week

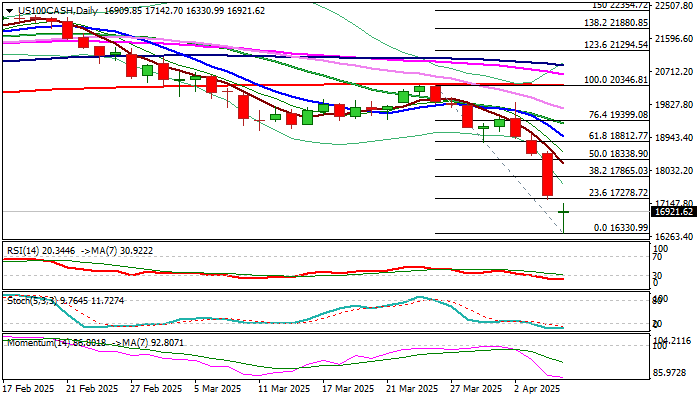

Nasdaq is consolidating above new multi-month low (16463, the lowest since January 2024) after suffering heavy losses in past three sessions and weekly loss of almost 10%.

Partial profit taking on deeply oversold daily studies would provide a breather for consolidation and likely positioning for fresh losses, as long as very negative fundamentals continue to sour the sentiment.

Gap-lower opening at the start of the week after heavy losses and last week’s closing below the base of thick weekly Ichimoku cloud, add to overall bearish picture, but overstretched daily indicators suggest that bears are likely to pause.

Initial barriers at 17278 (Fibo 23.6% of 20346/16330) and 17415 (weekly cloud base) are still intact and guard upper triggers at 17865 and 18338 (Fibo 38.2% and 50% respectively) which should cap extended upticks and keep larger bears in play.

Conversely, breach of these barriers would generate stronger positive signal and probably open way for stronger correction.

Res: 17278; 17415; 17865; 18338

Sup: 16342; 15700; 14949; 14063