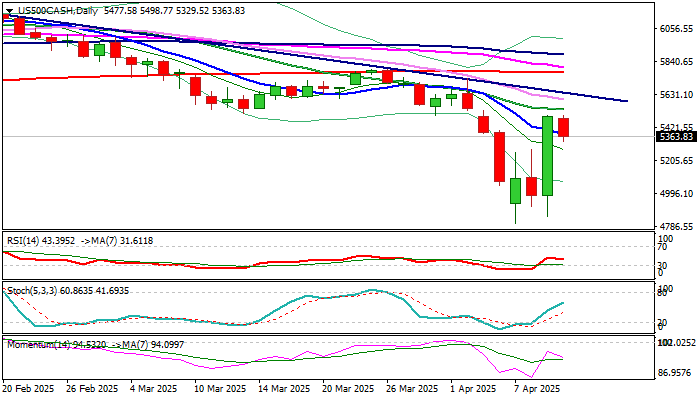

S&P rose sharply on tariff policy U-turn but more work at the upside is still needed to neutralize downside risk

S&P500 edged lower on Thursday after rallying 10.2% previous day (the biggest daily gains in over a decade).

Unexpected decision of President Trump to put heavy tariffs on a number of countries on hold for 90 days, revived optimism and lifted stock markets.

Although fresh rally retraced the largest part of heavy losses sparked by introduction of tariffs last week, markets remain cautious as the US tariffs on imports from China were not affected by the latest decision but were increased to 125%.

This raises worries of strong escalation of trade conflict between two world’s largest economies, which could have a domino effect on most countries.

Further development of the situation will be closely watched with positive scenario seeing a trade deal between two countries that would provide further relief and boost stock prices, while escalation would further sour the sentiment and add fresh pressure on prices.

Daily studies have slightly improved following Wednesday’s strong rally, but overall picture remains predominantly bearish and warn that downside risk still exists.

In ideal scenario, corrective dips from Wednesday’s peak should be shallow and contained above $5230 (Fibo 38.2% of $4801/$5495) to mark healthy correction and keep near term bias with bulls, though sustained break above $5500 zone, will be still needed to validate reversal signal.

Caution on dip and close below $5200/$5150 zone which could sideline fresh bulls and revive downside risk.

Res: 5457; 5496; 5532; 5636

Sup: 5330; 5267; 5230; 5200