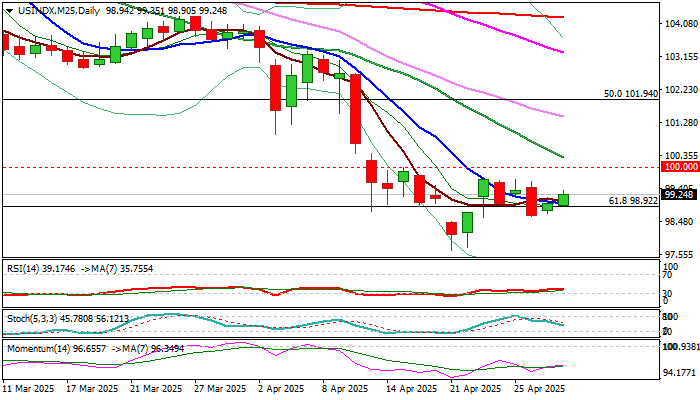

Dollar index is on track for the biggest monthly loss since November 2022

The dollar index remains constructive and edged higher on Wednesday after data showed that US economy slipped in the first quarter against consensus for a small rise, though it showed better results from expectations of some big US banks.

The greenback is still firmly negative overall, suggesting that larger bearish cycle is far from over and bear-trend is likely to resume after consolidation, fueled by current conflicting signals about possible solution for US-China trade conflict or its escalation.

The dollar index is on track for the third consecutive month in red, with steep downtrend from February peak, showing strong acceleration.

April’s drop presents the biggest monthly loss since November 2022, with monthly close below psychological 100 level to add to bearish signal, which still looks for verification on clear break below the floor of 2023/24 range (99.20) that would expose next significant support at 96.30 (bull-trendline off 2011 low).

Bearish daily studies suggest consolidation / limited correction should be ideally capped under solid resistances at 100.00/30 (psychological / falling 20 DMA) with extended upticks to be capped by daily Kijun-sen (100.98) to keep larger bears intact

Res: 99.72; 100.00; 100.30; 100.98

Sup: 98.63; 97.65; 96.30; 95.18