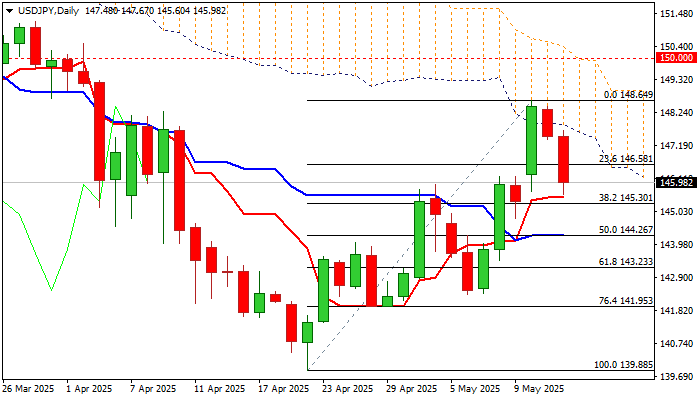

USDJPY – pullback accelerates on pressure from bull-trap /falling thick daily cloud

USDJPY extends pullback from new multi-week high (148.64) into second consecutive day, as overbought conditions prompted traders to collect profits.

Larger uptrend faced increased headwinds from falling daily Ichimoku cloud (brief penetration into cloud, spanned between 147.87 and 150.56 was short-lived) and also failed to clear Fibo barrier at 148.53 (76.4% of 151.20/139.88).

Bull-trap has been formed here that increased downside pressure, as falling thick cloud continues to weigh on near-term action.

Negative signals are developing on daily chart as bullish momentum is fading, stochastic emerging from overbought territory and south-heading RSI is approaching neutrality zone.

Fresh bears approach significant support at 145.30 (Fibo 38.2% of 139.88/148.64, reinforced by 10DMA), with clear break here to sideline larger bulls and open way for further easing towards 144.26 (50% retracement / daily Kijun-sen).

Near-term bias is expected to remain with bears while the price stays below 55DMA (146.50).

Res: 146.50; 147.67; 147.88; 148.64

Sup: 145.30; 144.82; 144.26; 143.80