Gold loses ground on fading safe haven demand

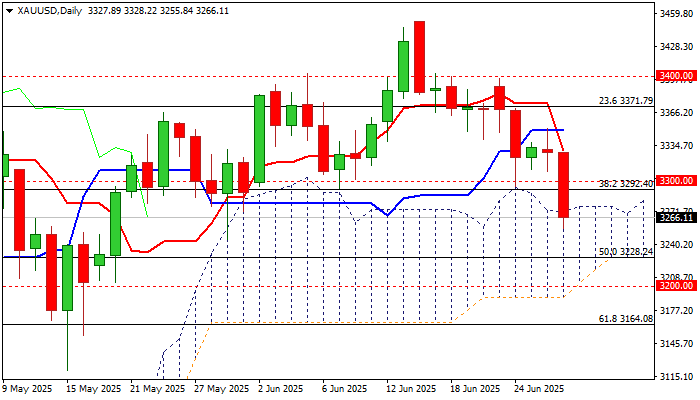

Gold accelerated lower (down almost 2%) on Friday after losing solid supports at $3300 zone, which previously contained several attacks.

The metal lost ground on sharply fading geopolitical tensions, as well as growing positive signs of final US-China trade deal that significantly deflated safe haven demand.

Gold is on track for the second consecutive weekly loss with formation of inverted hammer candle on monthly chart adding to concerns that larger bulls may be running out of steam.

The notion is supported by still strongly overbought monthly RSI and stochastic already out of overbought territory, with weekly indicators being in steep decline and significantly weaker daily studies (14-d momentum is diving deeper into negative territory / daily Tenkan/Kijun-sen created bear cross / price penetrated through the top of daily Ichimoku cloud).

Gold hit one-month low on Friday, with close within the cloud today, to confirm signal and keep the downside exposed, as the latest fall pushed the price into lower zone of larger consolidation range ($3500/$3120)

Bears eye targets at $3228 (50% retracement of $2956/$3500 rally) and $3203/00 (daily cloud base / psychological).

Meanwhile, corrective upticks (Friday partial profit taking) are likely to be limited, with cloud top ($3276) offering immediate resistance and $3000 to ideally cap and keep fresh bears intact.

Only return and weekly close above $3300 would question bears (scenario of false break lower and bear-trap formation).

Res: 3276; 3300; 3329; 3350

Sup: 3250; 3228; 3200; 3164