Japanese yen remains under increased pressure

Japanese yen fell across the board, with the recent weakness being sparked by President Trump’s decision to impose a 25% tariffs on imports from Japan.

Yen suffered the biggest losses against US dollar and Australian dollar, after the Australia’s central bank surprised markets on decision to keep interest rates on hold.

USD JPY hit new two-week high, as strong rally extends into second consecutive day (up 1.6% since Monday’s opening).

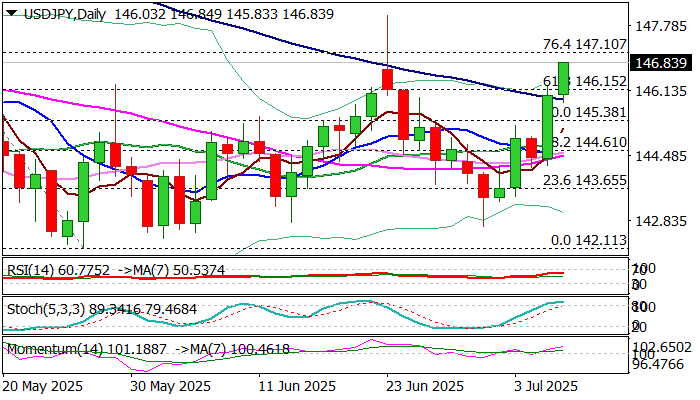

Monday’s list and close above top of daily cloud generated bullish signal, which was boosted by today’s surge through next pivotal barriers at 145.91 (100DMA) and 146.15 (Fibo 61.8% of 148.64/142.11 downtrend.

Daily studies improved (14-d momentum bounced from the centreline and MA’s 10/20/55/100) turned to bullish setup, although overbought stochastic warning that bulls may face headwinds on approach to next targets at 147.00/10 (round-figure / Fibo 76.4%).

Some technical easing should be anticipated, but mainly as positioning for further advance, as long as fundamental conditions remain unchanged and negative for yen.

Broken 100DMA (145.91) should ideally hold, with extended dips to stay above cloud top (145.54) and keep bulls in play.

Firm break of 147.00/10 to open way towards 148.02 (June 23 spike high) and unmask key short-term barrier at 148.64 (May 12 peak).

Res: 147.10; 147.67; 148.02; 148.64

Sup: 146.15; 145.91; 145.54; 145.20