Gold rises on weaker dollar

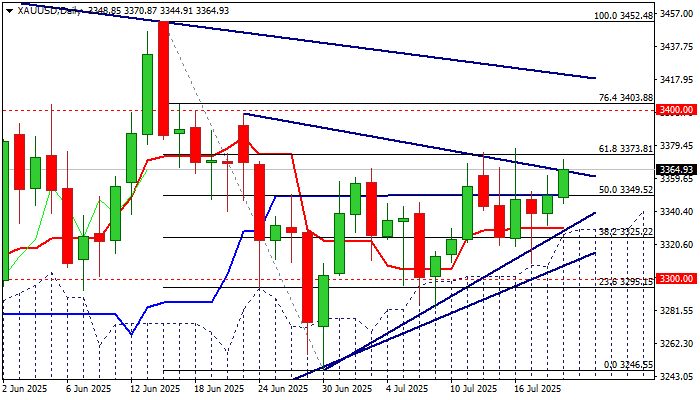

Gold price rose on Monday and moved to the upper part of near-term range ($3320/$3377) after another attack at the top of rising daily cloud was rejected last Thursday.

Rising daily cloud continues to underpin the action since January and proved to be very strong support after it contained several attack of consolidative / corrective phase under new record high ($3500).

Weaker dollar was mainly behind today’s advance, though safe-haven demand remains fueled by growing uncertainty over US tariffs, as President Trump’s Aug 1 deadline approaches and a number of countries (including EU, Japan) haven’t reached an agreement that keeps alive threats of 30% taxes to be imposed on all imports from these two countries.

On the other hand, traders also keep an eye on comments from Fed officials as the FOMC meets next week, to get more hints about the central bank’s next steps.

The Fed policymakers announced earlier that they will keep interest rates on hold as inflation unexpectedly rose in June and is likely to be boosted further by the consequences of new US import tariffs that is directly confronting Trump’s demands to reduce US interest rates to 1%, to attract investments and boost economic growth.

Fresh advance cracked the upper borderline of smaller triangle on daily chart ($3365) which guards next significant barriers at $3373/77 (Fibo 76.4% of $3452/$3246 / July 16 spike high – recent range tops) violation of which to generate bullish signal and expose targets at $3400/03 (psychological / Fibo 76.4%).

Conversely, repeated failure at tringle upper trendline would keep the price in extended but narrowing range.

Res: 3373; 3377; 3388; 3400

Sup: 3350; 3330; 3320; 3315