Dollar continues to trend higher as sentiment brightens after US-EU trade deal

The dollar index keeps firm tone and rallies to new five-week high on Tuesday, in extension of Monday’s 1.1% advance (the biggest one-day gain since May 12).

The greenback accelerated higher on Monday after US and EU reached a trade deal, which was very good for America and very bad for the Eurozone, as comments from top EU officials showed strong disappointment.

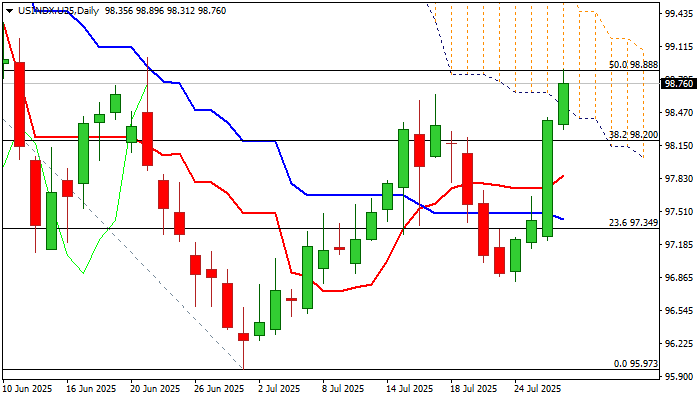

The dollar penetrated descending daily cloud (base lays at $98.53) and hit $98.88 (50% retracement of $101.80/$95.97 downtrend.

Fresh gains broke above previous recovery high at $98.65, with close above this level to complete bullish failure swing pattern on daily chart and add to positive signals.

Daily Tenkan-sen crossed above Kijun-sen and diverging, bullish momentum is strengthening, though overbought Stochastic may slow bulls in attempts to clear pivotal $99.00 resistance zone that would expose next strong barriers at $99.46/57 (daily cloud top / Fibo 61.8%).

Broken cloud base reverted to support which should ideally contain dips.

Markets await Fed’s rate decision and more significant signals about central bank’s policy outlook in coming months, as well as release of final of three US labor sector’s monthly reports (NFP, due on Friday) to get more information about the situation in the sector.

JOLTS report was released today and showed significant drop in job openings in June, with traders awaiting releases of ADP private sector payrolls (due on Wednesday) and NFP, to complete the picture.

Res: 98.88; 99.01; 99.35; 99.57

Sup: 98.53; 98.20; 97.86; 97.43