BTCUSD – bulls accelerate through 120K and near all-time high

BTCUSD surged through psychological 120K barrier and hit the highest in almost one month (122300) on Monday.

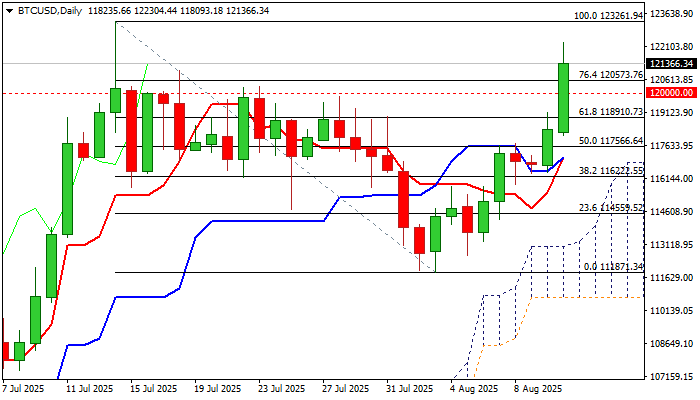

Recovery leg from 112K zone (higher base / the bottom of pullback from new record high) has strongly accelerated in past two sessions and retraced over 76.4% of 123261/111871 pullback), generating signal that corrective phase might be over soon.

The recent rally was driven by fresh institutional purchases, growing expectations of Fed rate cuts (following the latest disappointing numbers from US labor sector) as lower rates and weaker dollar are supportive factors, with broader support provided by significant positive changes in the US legislation of crypto markets.

Return above 120K added to positive technical picture (the price action remains underpinned by ascending and thickening daily cloud / converged daily Tenkan/Kijun-sen about to for a bull-cross and strong positive momentum) however, overbought stochastic warns that bulls may face headwinds on approach to key resistance (new record high).

This is already visible on hourly chart as the price eased from session high, with corrective action expected to stay above broken 120K level (reverted to solid support) to keep larger bulls intact for fresh push higher and potential attack at 123261 top.

Break higher will confirm strong bullish stance and push the price into uncharted territory, with Fibo projections (126000, 127600) and psychological 130K barrier, marking next targets.

Res: 122300; 123261; 126000; 127600

Sup: 120573; 120000; 118910; 118000