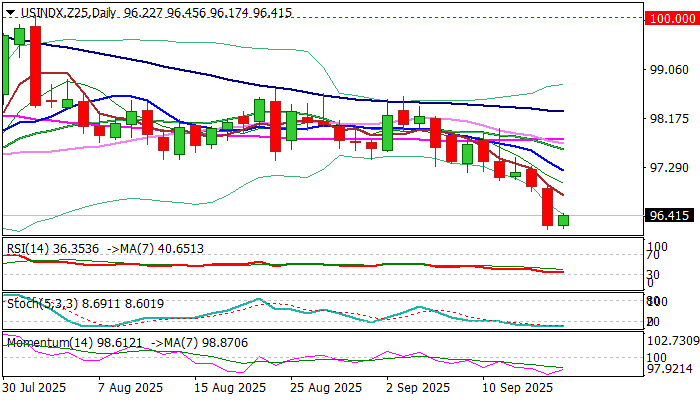

Dollar index – bears may accelerate if Fed signals a start policy easing cycle

Bears take a breather above new 11-week low on Wednesday, as markets await the verdict from Fed at the end of two-day policy meeting.

The dollar index extended the bear-leg from early Aug peak at 100 zone, a part of larger downtrend from early January peak at 110.00 (down around 12% for the year) and registered 1% loss in in the latest acceleration lower in past two days.

Wide expectations for Fed’s 0.25% rate cut today and high probability that the central bank would keep dovish stance and remain on track for further policy easing in coming months, added to factors that continued to pressure the US dollar.

Today’s upticks should stay capped under 96.80/97.20 zone (former low of July 24 / falling 10DMA) to keep broader bears intact.

Bears eye key support at 95.97 (2025 low, posted on July 1), loss of which will confirm a completion of 95.97/100.04 corrective phase and signal continuation of larger downtrend and expose immediate target at 95.18 (Fibo 76.4% of 89.15/114.72 uptrend.

Stronger acceleration lower cannot be ruled out (depending on Powell’s rhetoric) and may unmask psychological 90.00 level and 89.15 (2021 low).

Daily studies remain in full bearish configuration (boosted by the latest 20/55DMA bear cross) and support negative scenario, although oversold conditions should not be ignored.

Res: 96.82; 97.21; 97.42; 97.61

Sup: 96.16; 95.97; 95.01; 94.41