USDJPY – lift above daily cloud generates fresh bullish signal

USDJPY rose on Wednesday, underpinned by more cautious tone on monetary policy by Fed Powell and increased purchases by Japanese importers.

The dollar regained traction after chief Powell signaled that the central bank needs to have balanced approach as it faces two strong and opposite forces – weakening of the labor sector from one side and elevated inflation on the other.

Although Powells’ remarks were diverging from his recent comments, markets still price in two more rate cuts by the end of the year.

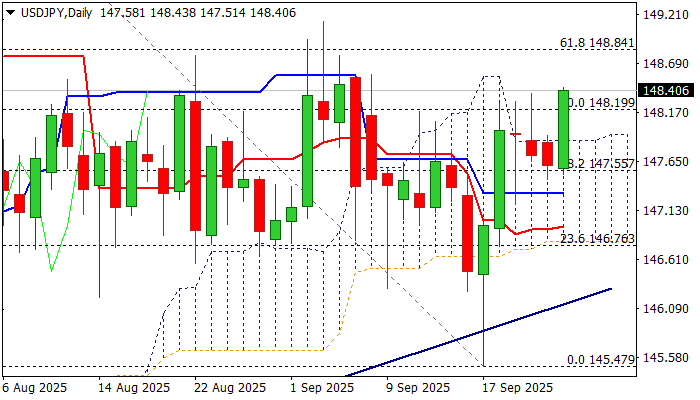

The US dollar advanced 0.5% until mid-European session on Wednesday, as fresh strength reversed drop in past three days and generated bullish signal on break above daily Ichimoku cloud (cloud top lays at 147.88).

Daily close above cloud to verify signal and strengthen near term structure for probe through next barrier at 148.49 (200DMA, currently under increased pressure), violation of which to generate signal of bullish continuation of recovery leg from 145.47 (Sep 17 spike low) and expose 149.13 (Sep 3 lower top).

Technical picture on daily chart is improving as MA’s are almost in full bullish setup and 14-d momentum attempts to break into positive territory, while the price holds above the top of thick daily cloud.

Recent formation of a bull-trap under 100DMA also underpins the action.

Res: 148.49; 148.84; 149.13; 149.63

Sup: 148.20; 147.88; 147.56; 147.19