Dollar – bulls face headwinds at important Fibo resistance

The dollar index keeps firm and holds near nine-week high on Thursday, on track for the best weekly performance in months.

Strong fall of Japanese yen amid political turmoil in Japan and deepening political crisis in the US and France, as well as less dovish than expected minutes of Fed’s latest policy meeting, were the key drivers of the greenback in past couple of days, after the dollar opened with gap-higher on Monday.

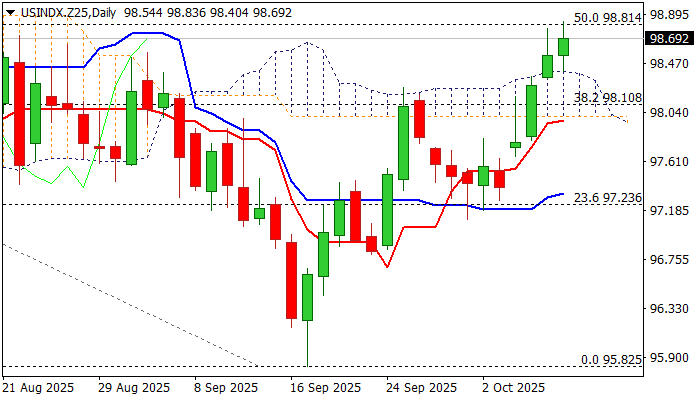

The latest rally surged through daily Ichimoku cloud (98.01 /98.40) and further improved positive technical picture on daily chart, although longer upper shadows on daily candles of Wed / today, suggest that bulls face headwinds from important barrier at 98.81 (50% retracement of 101.80/95.82 / falling weekly Kijun-sen).

Bulls may slow for consolidation at this zone, as overbought stochastic also contributes to such scenario, but should hold grip, especially if the price stays above daily cloud top (ideal scenario) of find firm ground above cloud base (98.01, reinforced by rising daily Tenkan-sen).

Sustained break of 98.81 pivot to generate initial signal of bullish continuation and expose targets at 99.51 (Fibo 61.8%) and 100 (psychological) in extension.

Res: 98.81; 99.00; 99.51; 100.00

Sup: 98.40; 98.10; 98.01; 97.70