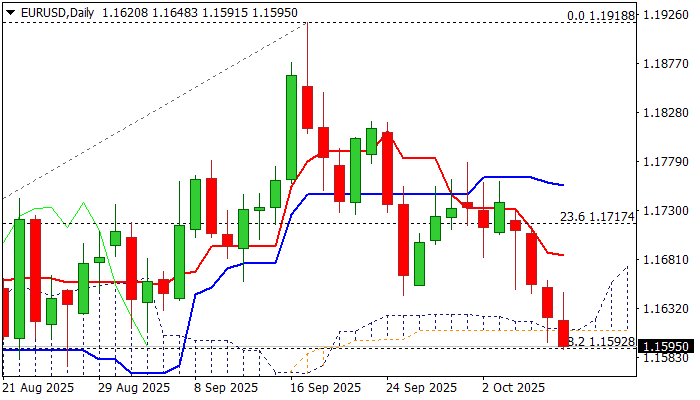

EURUSD – break of key 1.1600 support zone to spark fresh weakness

The Euro remains in red for the fourth consecutive day and pressuring again key supports at 1.1600 zone (thin daily cloud / double Fibo support – 38.2% of 1.1065/1.1918 ascend and 61.8% of 1.1391 / 1.1918 upleg) after attack on Wednesday failed here.

Political crisis in France was among Euro’s key drivers lately, with markets awaiting decision of President Macron to appoint new Prime Minister.

The single currency may fall further if the crisis deepens further, while positive signals in appointing new PM and government may provide relief.

From that perspective we see 1.1600 zone (1.1610 – thin daily cloud and 1.1592 – Fibo 38.2% / Fibo 61.8%) as a key point, violation of which would confirm bearish continuation (already signaled by daily Tenkan-Kijun-sen bear cross and completion of daily bearish failure swing pattern) and spark acceleration towards 1.1516/00 (Fibo 76.4% / psychological).

Daily moving averages and 14-d momentum in bearish setup add to negative near-term outlook.

Broken supports at 1.1631 (100DMA) and 1.1655 (broken 50% retracement) should cap upticks and keep bears in play.

Res: 1.1631; 1.1655; 1.1676; 1.1693

Sup: 1.1574; 1.1556; 1.1516; 1.1500