Fresh risk appetite lifts Australian dollar to two-week high

AUDUSD opened with a gap higher and hit two-week high in almost 1% advance in early Monday trading.

Fresh risk appetite dominated in the market at the start of the week, as growing optimism of US-China trade deal, fueled demand for riskier assets and inflated risk-sensitive Aussie dollar.

Softer US dollar on cooler than expected US inflation in September (report released on Friday) also contributes to fresh strength.

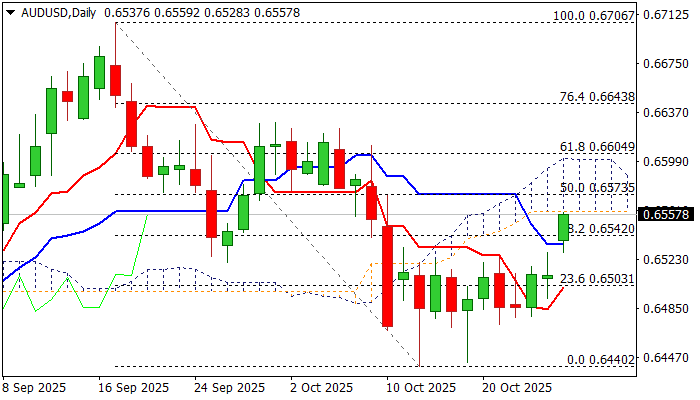

Monday’s acceleration pressures significant resistance at 0.6560 (base of daily Ichimoku cloud, spanned between 0.6560 and 0.6600) where increased headwinds could be expected, as daily studies are mixed (north-heading 14-d momentum is still in the negative territory / stochastic is overbought against rising RSI that moved above 50 and MA’s turning to bullish setup).

Bullish scenario requires penetration of daily cloud and rise above nearby 0.6573 Fibo barrier (50% retracement of 0.6706/0.6440) to strengthen near-term structure and open way for attack at next key barriers at 0.6600 zone (cloud top / Fibo 61.8%).

Conversely, failure at cloud base may keep an action on hold, but biased higher while holding above 100DMA (0.6533).

Investors await Fed’s rate decision, due on Wednesday (0.25% rate cut is widely expected, with focus on speech of Fed chief Powell, expected to provide signals of central bank’s next steps, as well as release of US PCE Index on Friday, Fed’s preferred inflation gauge).

Res: 0.6560; 0.6573; 0.6600; 0.6629

Sup: 0.6542; 0.6533; 0.6500; 0.6472