AUDNZD accelerates lower after RBNZ’s hawkish cut

The pair fell one full figure and hit the lowest in almost one month after the Reserve Bank of New Zealand cut rates by 25 basis points, as expected, but signaled pause that lifted kiwi dollar.

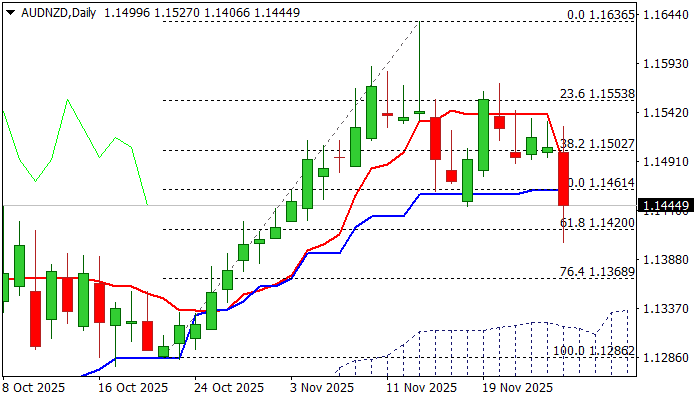

Fresh weakness extended below Nov 18 higher low at 1.1443, with sustained break here to generate fresh signal on completion of bearish failure swing and keep the downside in focus.

The structure on daily chart weakened as falling 14-d momentum broke into negative territory and converging 10/20DMA’s are about to form bear-cross.

On the other hand, quick bounce from the session low (1.1406, slightly below Fibo 61.8% of 1.1283/1.1636 upleg), signals that bears face headwinds at pivotal 1.1400 zone, but bearish hourly studies add to scenario of limited upticks providing better levels to re-enter bearish market.

The notion is supported by hotter than expected Australia’s October inflation which is likely to increase pressure on RBA and sour the sentiment of Aussie dollar.

Daily close below broken Fibo 50% (1.1460) is required to keep near-term action biased lower and risk renewed attack at 1.1400 zone, violation of which would expose key supports at 1.1316/1.1286 (top of ascending daily cloud / Oct 22 higher low).

Res: 1.1460; 1.1500; 1.1527; 1.1553

Sup: 1.1418; 1.1400; 1.1367; 1.1316