Dollar continues to travel south on growing rate cut bets / weak economic data

The dollar index came under increased pressure on Monday and fell to two-week low, following renewed rise in bets for Fed rate cut in the last policy meeting this year, as markets await releases of key economic indicators from the US labor sector, which could contribute to such decision.

The report released today showed that US manufacturing sector remains in a downward trajectory for the ninth consecutive month, with higher prices on tariffs and significant drop in orders, being mainly behind the slump that added pressure on greenback.

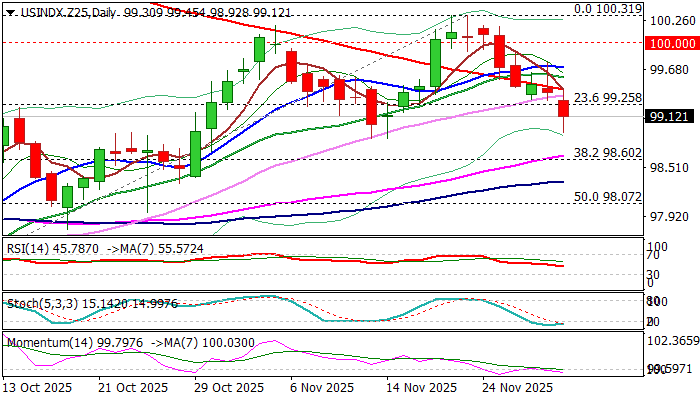

Daily studies weakened as 14-momentum indicator stays in the negative territory and price dips further below broken 200 /20/10DMAs and approaching pivotal support at $98.85 (Nov 14 higher low), where stronger headwinds could be expected, as stochastic is oversold.

Limited upticks should hold below 200DMA (99.43) to keep near-term bias with bears and offer better levels to enter fresh shorts.

Bull-trap at $100 level and initial signal of formation of reversal pattern on monthly chart contribute to negative scenario, although firm break of $98.85/60 zone (Nov 14 low / 55DMA / Fibo 38.2% of $95.82/$100.31) is still required to signal reversal on daily chart and open way for further retracement of $95.85/$100.31 rally.

Res: 99.25; 99.43; 99.70; 100.00

Sup: 98.85; 98.60; 98.34; 98.07