AUDUSD advances for the eleventh straight day

AUDUSD holds in steep uptrend for the eleventh consecutive day and on track for the second straight weekly gain, mainly driven by weaker US dollar on growing expectations of Fed rate cut, but also holding firm tone against other major currencies.

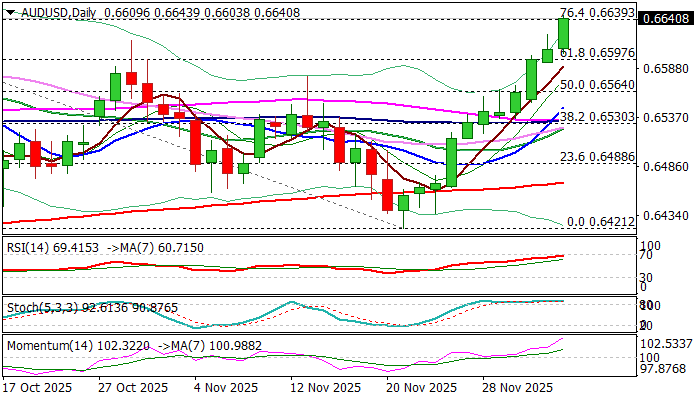

The pair hit new 2 ½ month high on Friday and cracked strong barriers at 0.6640 (200WMA / Fibo 76.4% of 0.6706/0.6421 descend) where bulls may face headwinds, as daily studies are overbought and Friday’s profit-taking may also contribute to potential price easing.

Investors await release of (delayed) US Sep PCE price index, one of Fed’s inflation gauges, which is to provide additional information to US policymakers ahead of next week’s policy meeting.

Firmly bullish daily studies (multiple MA bull-crosses / strong positive momentum) underpin the action, with dips to ideally find ground above 0.6600 zone (broken Fibo 61.8% / hourly higher low / top of hourly Ichimoku cloud), while potential deeper pullback should be contained by top of daily cloud / broken Fibo 50% (0.6560) to still mark a healthy correction and provide better levels to re-enter strong bullish market for push towards 0.6706 (2025 peak, posted on Sep 17).

Res: 0.6660; 0.6688; 0.6706; 0.6730

Sup: 0.6630; 0.6600; 0.6560; 0.6541