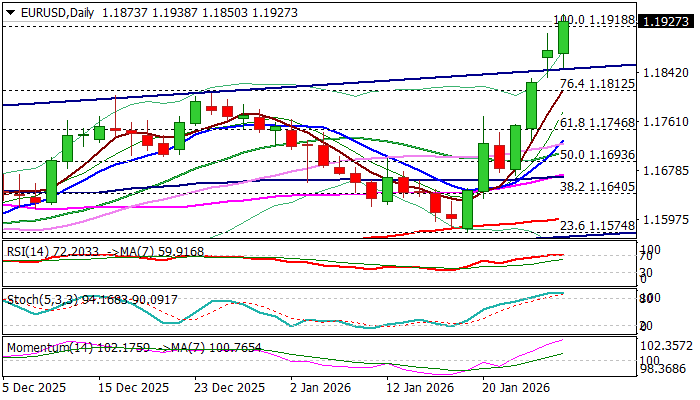

EURUSD – bulls approach 1.20 barrier

The Euro keeps firm tone and holds near fresh multi-month high (1.1907, posted on Monday) following last week’s strong rally and gap-higher opening at the start of this week.

Weak dollar with signals of possible deeper drop, was mainly behind the latest advance.

Friday’s close above broken Fibo 76.4% of 1.1918/1.1468 (1.1812) confirmed firm bullish stance.

Monday’s action, despite opening with gap-higher, showed signs of hesitation on approach to key barrier at 1.1918 (2025 peak, the highest since June 2021), due to significance of resistance, as well as overbought daily studies, but fresh strength on Tuesday sidelined concerns about potential pause, on push through 1.1918 pivot.

Daily close above this level is needed to confirm signal and fully expose next strong barriers at 1.1950 (200MMA); 1.1984 (bear-trendline connecting peaks of 2018 and 2021) and 1.2000 (psychological).

Multiple daily MAs bull-crosses and very strong positive momentum, support scenario, but overbought conditions require caution.

Consolidative / corrective action should hold above 1.1850 (today’s low / broken upper boundary of bull-channel) to keep larger bulls in play.

Res: 1.1950; 1.1984; 1.2000; 1.2025

Sup: 1.1900; 1.1850; 1.1812; 1.1760