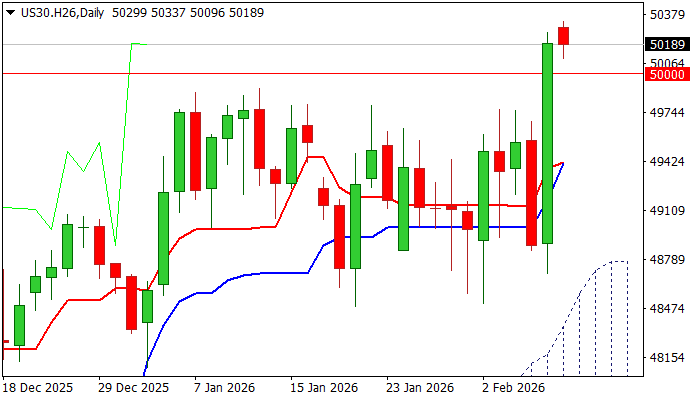

Dow-Jones – bulls consolidate after hitting new record high above 50K

Dow eases from new record high (50337) on Monday but remains steady and holds above broken magic 50K barrier that was taken out last Friday after almost 2.7% advance (the biggest daily gain since 9 April 2025).

The index outperformed major Wall St peers, with gains of Caterpillar, Goldman Sachs and Nvidia shares being mainly behind the latest strong rally.

Violation and weekly close above 50K (also the top of recent range at 49900) was strong bullish signal which looks for validation on sustained break higher that would open way towards projections at 50434, 50599, 50764 and 51000 round figure barrier.

Positive daily studies (strong bullish momentum, MAs in bullish setup and the action being underpinned by rising and thickening daily cloud) remain supportive, along with formation of bullish engulfing pattern (Friday).

Profit taking after strong gains last Friday should be limited and provide better levels to re-enter bullish market, as overall environment remains positive.

Broken 50000 barrier and 49900 former range top reverted to solid supports which should ideally hold dips and keep bulls intact.

Res: 50337; 50434; 50600; 50764

Sup: 50000; 49900; 49750; 49400