Strong pressure on crude stocks build and trade tensions persists

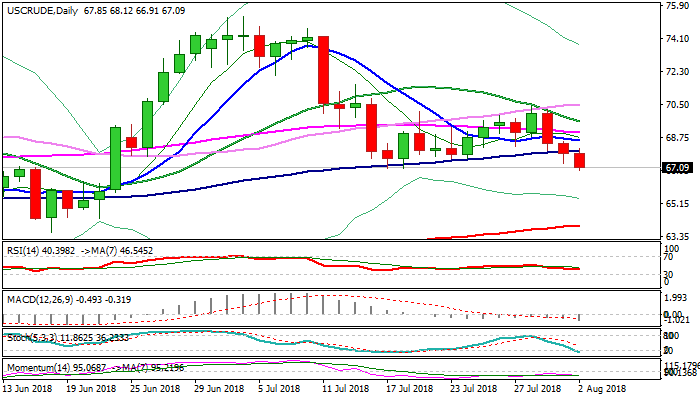

WTI oil holds firmly in red for the third straight day and probes below key support at $67.03 (17/18 July lows) on Thursday.

Surprise rise in crude inventories of 3.8 million barrels vs forecasted draw of 2.8 million barrels, added to existing pressure on increased output and concerns over trade tensions between the US and China.

Wednesday’s surge through thin daily cloud and close below important Fibo support at $68.07 (61.8% of $63.58/$75.34 rally) was bullish signal, which looks for confirmation on sustained break below $67.03 pivot.

Completion of failure swing pattern on daily chart on break below $67.03 would open way for extension towards $66.36 (Fibo 76.4%) initially.

Daily techs in firm bearish setup support the notion, with bears to be possibly interrupted by limited upticks on oversold conditions.

Broken 100SMA which was key near-term support, now marks solid resistance at $68.03, expected to ideally cap.

Only extension above pivots at $68.99 (falling 55SMA) would sideline bears.

Res: 67.57; 68.03; 68.58; 68.99

Sup: 66.91; 66.36; 65.71; 64.33