Mixed techs lack clearer direction signal despite Thursday’s strong rally

WTI oil price holds within narrow consolidation on Friday, after strong rally previous day. Reports on unexpected fall in US crude supplies boosted oil price, temporarily offsetting negative impact from rising crude stocks and higher output from major oil producers.

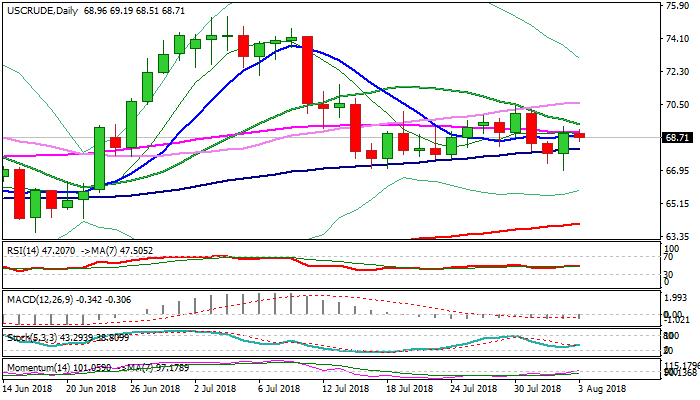

Thursday’s rally retraced over 61.8% of $70.42/$66.91 bear-leg but failed to confirm bullish signal on close above cracked 55SMA ($68.98) and Fibo barrier at $69.08.

However, daily techs improved on yesterday’s rally, as momentum emerged from oversold territory and slow stochastic turned north, but MA’s remain mixed and lacking to generate clearer direction signal.

Bullish scenario requires close above $68.98/$69.08 pivots to signal further advance, which would confirm double-bottom on extension above $70.42 (30 July peak).

Conversely, return and close below rising 10SMA ($68.13) would generate bearish signal and re-expose lows at $67.03/$66.91.

Res: 68.98; 69.08; 69.43; 70.00

Sup: 68.51; 68.13; 67.03; 66.91