Extended consolidation is seen as likely scenario before bulls resume

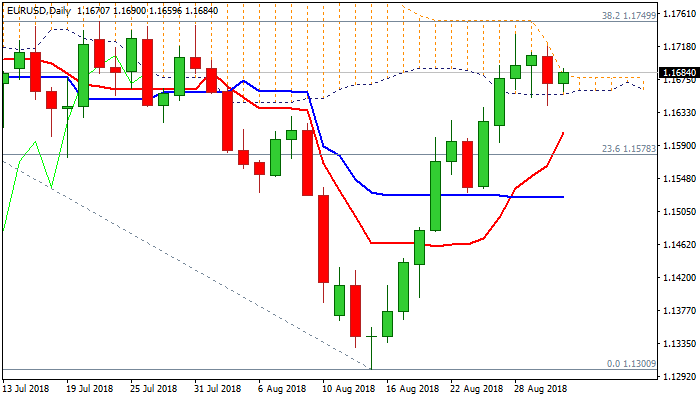

The Euro holds in a narrow range and within narrowing daily cloud in early Friday’s trading, maintaining bullish bias despite Thursday’s close in red.

Overall bulls are showing signs of fatigue as slow stochastic reversed from overbought territory after forming bearish divergence, but downside attempts were so far limited by cloud base and strong momentum offsets bearish threats for now.

Positive signals are also developing on weekly chart, as the pair is on track for the third consecutive bullish weekly close with further bullish signal seen on close above weekly 10SMA (1.1620).

Extended consolidation is expected to be likely scenario as bulls look for a catalyst to continue higher.

However, deeper pullback cannot be ruled out as negative signals are developing, with bull-cross of 10/55SMA’s offering solid support at 1.1620 zone and guarding pivotal support at 1.1568 (Fibo 38.2% of 1.1300/1.1733 rally).

Res: 1.1690; 1.1718; 1.1733; 1.1750

Sup: 1.1641; 1.1620; 1.1568; 1.1542