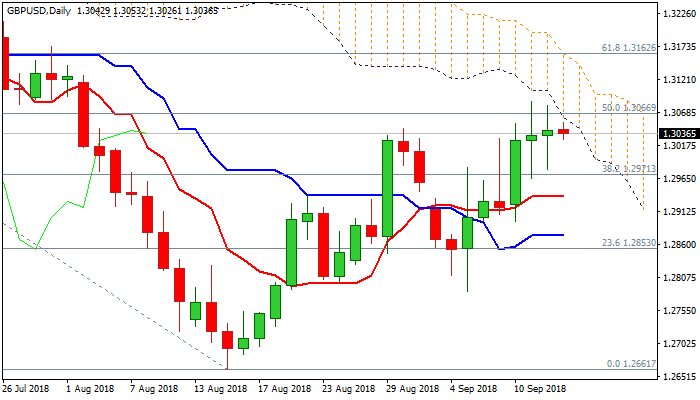

Falling daily cloud and double-Doji weigh on bulls; BoE eyed for fresh signals

Double long-legged Doji candles in past two days warn that bulls might be running out of steam as recent rally faces strong headwinds from falling and widening daily cloud (cloud base lays at 1.3060 today).

Daily slow stochastic is reversing from overbought territory and creating bear-cross and 14-d momentum is turning lower, adding to negative signals.

On the other side, daily MA’s are in bullish setup and formed multiple bull-crosses, along with repeated close above 55SMA, offsetting stronger negative impact for now.

Daily 55SMA marks initial support at 1.3012 and sustained break lower would generate initial negative signal, with extension and close below 10SMA (1.2957) to signal reversal.

Conversely, penetration into daily cloud will be positive signal, with confirmation of bullish continuation seen on break above cloud top (1.3162) reinforced by Fibo 61.8% of 1.3472/1.2661 descend.

Bank of England is holding its monetary policy meeting today, with expectations to keep rates at 0.75% after hike in August.

The central bank will likely stay on hold until Britain leaves the European Union in March next year, but markets will be closely watching the message from the BoE for fresh signals.

Brexit remains the main theme and despite the recent positive signals of reaching deal in coming weeks, Britain’s economy remains at the back foot since 2016 Brexit vote, with rising concerns about the future trading relationship with the EU, which remains unclear.

Res: 1.3060; 1.3087; 1.3162; 1.3185

Sup: 1.3026; 1.3012; 1.2979; 1.2957