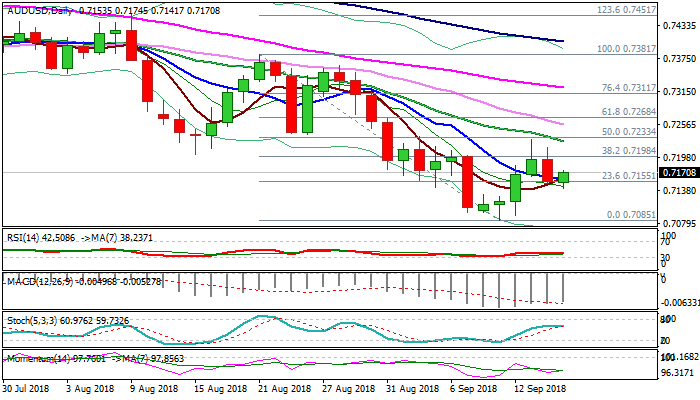

Aussie attempts to recover Friday’s losses; US/China trade conflict is key driver

The Aussie dollar attempts to regain traction after dipping on Friday, which ended day in red.

Concerns about an escalation of US/China trade conflict may weigh on near-term risk, with further news eyed for fresh direction signals.

Overall outlook remains negative, as last week’s recovery attempts were capped by falling 20SMA and momentum is weak.

Pivotal support at 0.7140 (Fibo 61.8% of 0.7085/0.7229 upleg) holds for now, with break here to open way for retest of key support at 0.7085 (11 Sep 2 ½ year low).

Initial bullish signal could be expected on break above 20SMA (0.7226), with extension above 0.7268 (Fibo 61.8% of 0.7381/0.7085) needed to confirm reversal and open way for stronger recovery.

Res: 0.7198; 0.7226; 0.7268; 0.7323

Sup: 0.7141; 0.7085; 0.7000; 0.6906