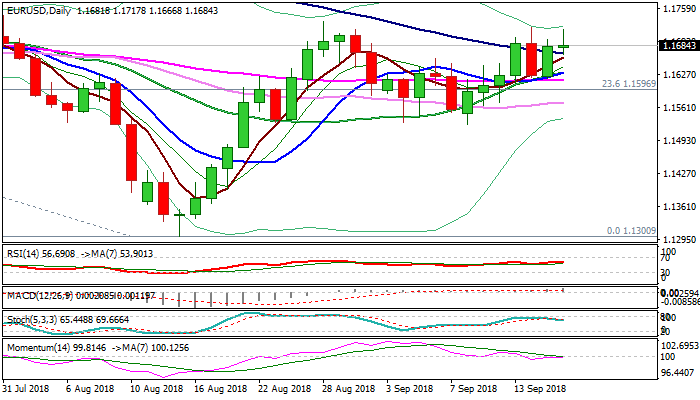

Bullish bias above 100SMA; further news from US-China trade conflict to provide fresh signals

The Euro remains steady and extended previous day’s strong rally but gains stalled ticks ahead of last Friday’s peak at 1.1721, but subsequent pullback on new US tariffs was contained by broken 100SMA (1.1669) which now acts as initial support.

Conflicting daily techs (south-heading slow stochastic and weakening momentum against bullish setup of daily MA’s) lack clearer signals, with focus turning towards US-China trade conflict and response from China on the newest measures from the US.

Initial comments from China were conciliatory, preventing deeper losses, however, further response from China could be anticipated and would the key market driver.

Converged 10/20SMA’s (1.1631) mark next strong support below 100SMA, which is expected to hold extended dips and maintain bullish bias.

At the upside, plethora of resistances lays between 1.1733 (28 Aug high) and 1.1780 (Fibo 38.2% of 1.2555/1.1300 fall), with sustained break higher needed to generate stronger signal for continuation of recovery leg from 1.1300 (15 Aug low).

Res: 1.1721; 1.1733; 1.1750; 1.1780

Sup: 1.1669; 1.1631; 1.1615; 1.1571