Risk of upside stall on trade war escalation and fresh risk aversion

The maintains bullish bias on Tuesday but gains were so far limited as the price fell quickly from new high at 112.27, posted in early Europe.

Expectations that China will retaliate to the newest US package of tariffs increases concerns of escalation of trade war which could produce fresh risk aversion and boost safe-haven yen.

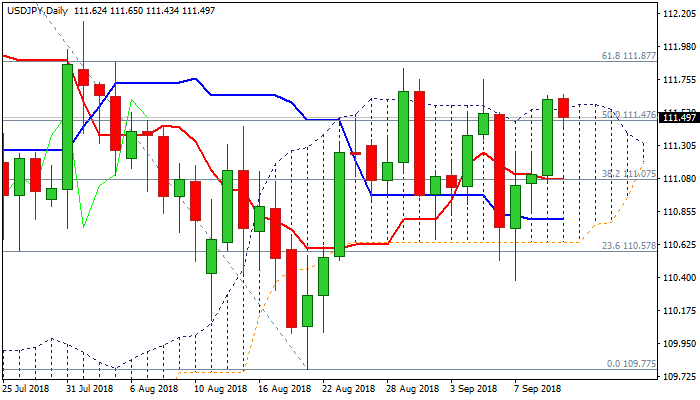

Weakening momentum on daily and weekly charts supports scenario, which needs confirmation on return and close below 10SMA (111.51), to open way for further weakness.

Daily cloud is narrowing and will twist early next week (111.21), which could also attract weakness.

Conversely, break and close above Fibo barrier at 112.37 (76.4% of 113.17/109.77) would neutralize bearish threats and signal further advance.

Res: 112.27; 112.37; 112.62; 112.92

Sup: 111.87; 111.66; 111.51; 111.30