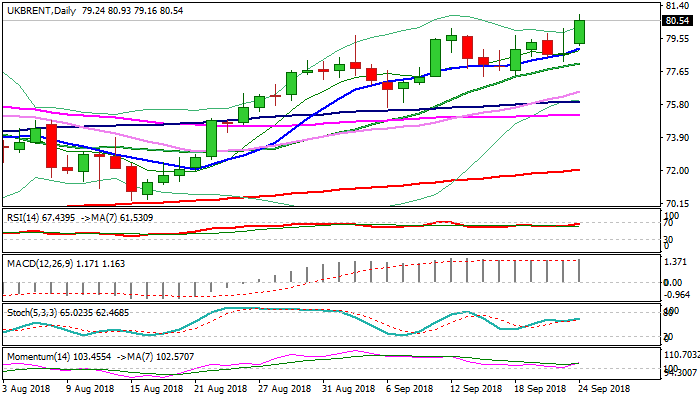

Brent hits highest levels since Nov 2014

Brent oil hit new nearly four-year high at $80.93 on Monday, after fresh bullish acceleration through psychological $80 barrier broke above former high at $80.48 (17 May).

Renewed bullish sentiment after Saudi Arabia said it is comfortable with Brent price above $80, as well as looming US sanctions on Iran which already started to bite, underpinned fresh rally.

Technical studies in full bullish configuration add to growing bullish sentiment.

Bulls need close above $80.48 to open way towards next key barrier at $81.84 (Fibo 61.8% of $115.68/$27.09, 2014/16 fall).

Daily indicators head north and show enough space for stretch towards $81.84 pivot, break of which would generate next strong bullish signal.

Meanwhile, bulls may consolidate before continuing, on profit-taking after today’s rally. Broken $80 barrier should ideally hold to keep fresh bulls intact.

Deeper dips would face strong support at $78.96 (rising 10SMA), with firm break here to sideline immediate bulls and signal false break higher.

Res: 80.93; 81.15; 81.84; 82.19

Sup: 80.48; 80.10; 79.16; 78.96