Bulls consolidate after cracking 113 barrier; Fed in focus

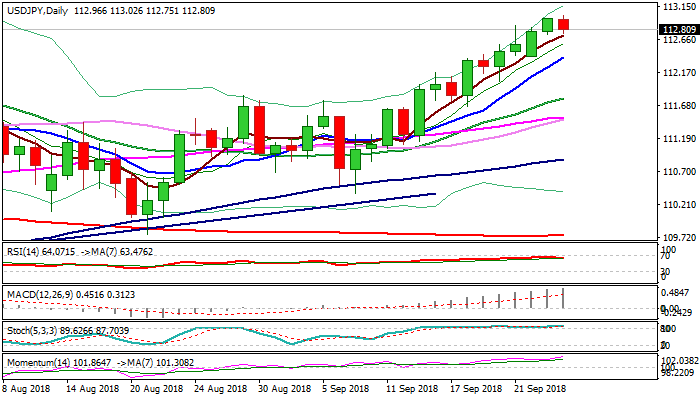

The dollar dipped to 112.75 in early European trading on Wednesday after eventually cracking psychological 113 barrier in Asia.

Overall bullish structure favors further upside and final attack at key barriers at 113.17 (19 July high) and 119.30 (Fibo 61.8% of 118.66/104.63).

All eyes are on Fed, which ends its two-day policy meeting today. Markets widely expect 0.25% rate hike and will also look for comments from the central bank for guidance on future steps, as another hike towards the year is expected.

The greenback benefited from hawkish policy outlook during past months, with further advance seen on Fed continuing at the same path.

Sustained break above 113.17/30 pivots would generate bullish signal for continuation of uptrend from 104.63 (2018 low), interrupted by 113.17/109.77 pullback, towards targets at 114.50/74 (July / Nov 2017 highs).

Dip-buying remains favored scenario for now, with initial support at 112.72 (rising 5SMA) and extended downticks to be contained by ascending 10SMA (112.40).

Res: 113.02; 113.17; 113.30; 113.75

Sup: 112.72; 112.40; 112.25; 112.04