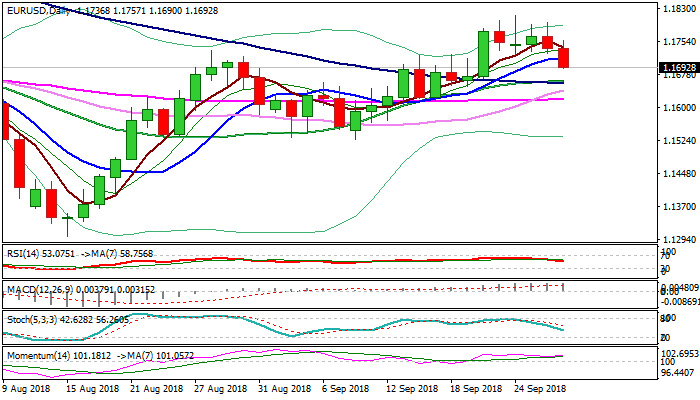

Signal of deeper pullback on extension below 10SMA

The Euro holds in red on Thursday and dips to one-week low at 1.1690, as hawkish Fed boosted the greenback.

As expected, the Fed raised interest rates by 0.25% but also removed the word accommodative from its policy statement, signaling that the central bank is on the way for further rate hikes.

American economy is strong, with inflation holding near 2% projection, labor sector showing a number employed people rising steadily and wages are also climbing, which creates an environment for Fed to continue tightening.

The EURUSD pulls back after five consecutive failures to clearly break above Fibo barrier at 1.1780 (61.8% of 1.2555/1.1300), which generated initial negative signal.

Today’s extension below former congestion low (1.1724) and Fibo 38.2% of 1.1526/1.1815 upleg (1.1704) was additional bearish signal.

Close below the latter is needed to confirm scenario and open supports at 1.1662/52 (converged sideways-moving 20/100SMA’s), with extension towards next strong supports at 1.1641/36 (rising 30SMA / Fibo 61.8% of 1.1526/1.1815).

Despite significantly weaker structure on lower timeframes, momentum on daily chart remains firm and still holding above its 7-d SMA, which could affect fresh bears.

Overall bullish picture sees dip-buying favored while 30SMA holds dips.

Res: 1.1711; 1.1738; 1.1757; 1.1780

Sup: 1.1670; 1.1652; 1.1641; 1.1617