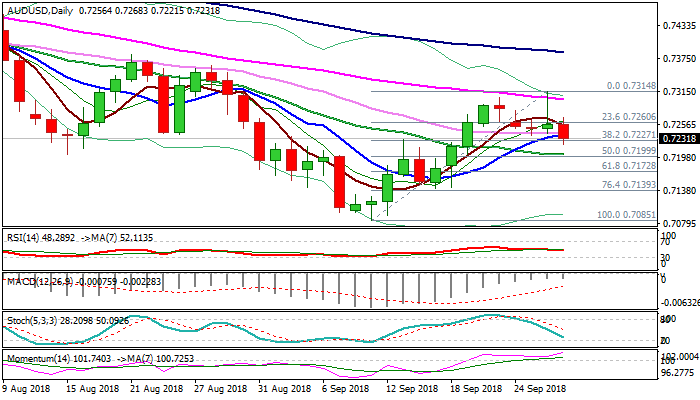

Aussie dips further after strong rejection above key 55SMA barrier

The Aussie dollar accelerated lower on Thursday after spiking to new one month high at 0.7314 immediately after Fed on Wednesday.

Probe above kay barrier at 0.7304 (falling 55SMA) was short-lived, with Wednesday’s action ending in daily candle with long upper shadow and subsequent extension lower was driven by stronger dollar after Fed.

Fresh bears broke below 10SMA, generating negative signal for extension towards next pivot at 0.7202 (20SMA), however, close below 10SMA is needed to confirm scenario.

Strong bullish momentum on daily chart conflicts MA’s in bearish setup and south-heading slow stochastic.

The pair might be looking for further signals after Fed, with US/China trade conflict being in focus.

Res: 0.7241; 0.7268; 0.7300; 0.7314

Sup: 0.7221; 0.7202; 0.7172; 0.7144