Concerns of impact from sanctions on Iran offset negative impact from build of crude inventories

WTI oil regained traction and bounced to $72.58 on Thursday, as persisting fears on tighter oil markets on upcoming US sanctions on Iran offset negative impact from rise in crude stocks.

EIA report on Wednesday showed a build of 1.85 million barrels vs forecasted draw of 1.27 million barrels and previous week’s fall of 2.05 million barrels.

Also, the US ruled out release of emergency crude reserves, which aimed to prevent oil prices of spiking higher and adding to bullish sentiment.

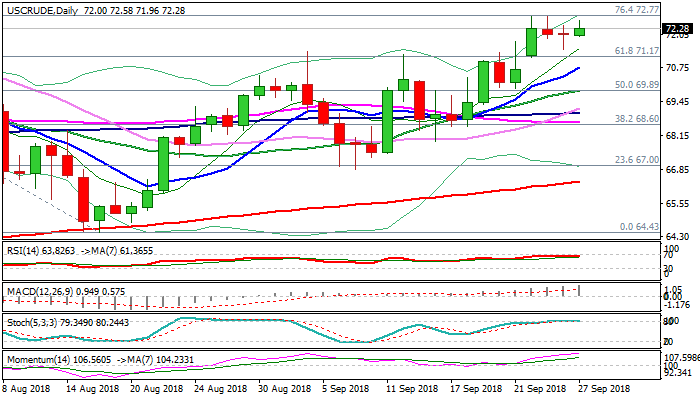

Today’s fresh advance after Wednesday’s action ended in long-legged Doji signals that pullback from new 2 ½ month high at $72.73 might be over.

Bullish techs add to prevailing positive sentiment and keep focus at the upside for eventual break through Fibo barrier at $72.77 (76.4% of $75.34/$64.43 descend) and continuation of an uptrend from $64.43 (16 Aug low).

Session low at $71.96 marks initial support, followed by Wednesday’s spike low at $71.47 and pivotal $71.17 support (broken Fibo 61.8% of $75.34/$64.43) loss of which would generate stronger bearish signal.

Res: 72.77; 73.64; 74.00; 74.25

Sup: 71.96; 71.47; 71.17; 70.76