News from Italy provide temporary relief; bears in play under 1.1650

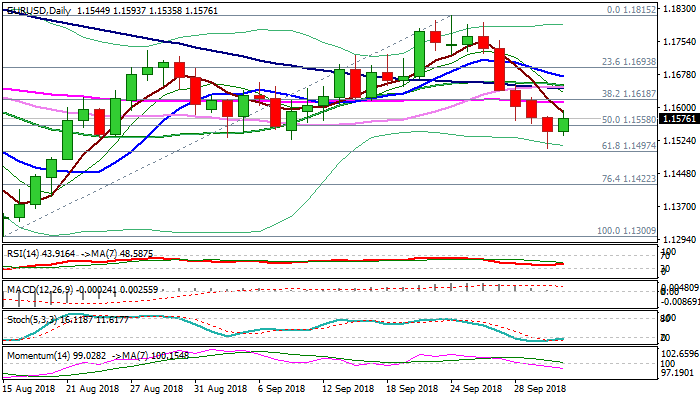

The Euro bounced on Wednesday after five-day fall from 1.1797 lower top found footstep at 1.1500 zone (psychological support / Fibo 61.8% of 1.1300/1.1815 ascend / daily cloud base).

News that Italy revises its budget plans, after initial announcement on Monday shook markets and sent Euro lower, offered fresh support to the single currency.

Recovery was signaled by reversal of oversold daily slow stochastic, which also formed bull-cross and is about to emerge from o/b territory and Tuesday’s long-tailed daily candle, formed after strong downside rejection.

On the other side, strong bearish momentum suggests that bears remain in play and current move seen as positioning for fresh downside, with limited recovery expected as problem with Italy’s budget is not solved yet.

Falling 55SMA marks first strong resistance at 1.1611, with extended upticks expected to be capped at 1.1650 zone (converged 100/30/20 SMA), to keep bears in play.

Markets await fresh news from Italy for further signals, along with EU Services PMI and retail sales data.

Bearish scenario needs close below 1.15 handle to signal continuation and expose next support at 1.1422 (Fibo 76.4% of 1.1300/1.1815 rally).

Alternatively, sustained break above 1.1650 resistance zone is needed to neutralize bears and signal further recovery.

Res: 1.1593; 1.1611; 1.1650; 1.1672

Sup: 1.1535; 1.1497; 1.1480; 1.1422