Limited recovery keeps the downside vulnerable

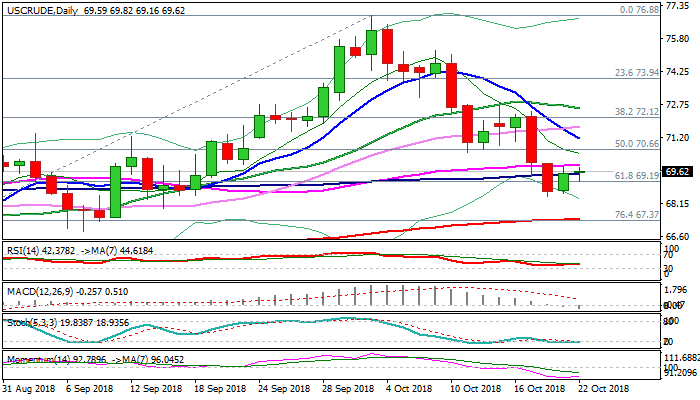

WTI oil price stands at the front foot in early Monday’s trading, following Friday’s bounce from daily cloud base, where bears were repeatedly rejected, but recovery attempts struggle at daily cloud top ($69.61) and were so far unable to clearly break higher.

Strong fall in past two weeks ($76.88/$68.46) found footstep and may hold in consolidative / corrective action in coming sessions.

Bullish divergence on oversold slow stochastic supports scenario, with firm break above pivots at $69.61/91 (daily cloud top / 55SMA) needed to signal stronger recovery.

Comments over the weekend that Saudi Arabia would retaliate on recent strong criticism over the death of Saudi journalist and impose oil embargo on western consumers, kept oil price recovery attempts limited.

The downside would remain vulnerable while cloud top / 55SMA cap as overall picture on daily chart is bearish and sees risk of further weakness towards next strong support at $67.42 (200SMA), after Friday’s close below $69.19 (Fibo 61.8% of $64.43/$76.88 ascend) generated bearish signal.

Res: 69.61; 69.91; 70.49; 71.14

Sup: 69.16; 68.61; 68.46; 67.93