Bears are positioning for fresh downside; modest impact from UK budget report expected

Cable is consolidating within narrow range above new nine-week low at 1.2776 in early Monday’s trading, ahead of release of UK autumn budget.

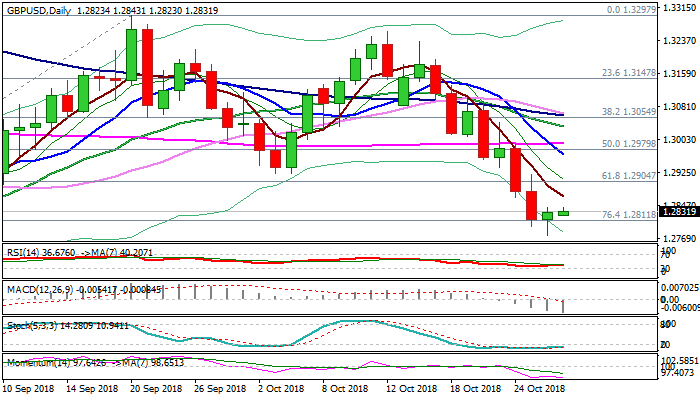

Larger bears off 1.3257 (12 Oct high) are taking a breather after showed initial signs of stall at 1.2811 Fibo support (76.4% of 1.2661/1.3297 rally).

Repeated failure to close below 1.2811 and positive close on Friday (long-tailed daily candle) suggest the pair may hold in extended consolidation, with stronger upticks not ruled out.

Oversold daily slow stochastic is reversing and supporting the notion, however, overall bearish picture sees upticks as positioning for fresh weakness.

Former pivotal supports at 1.2904/21 (broken Fibo 61.8% / former base) mark initial barriers, with falling 10SMA (1.2967) expected to cap extended upticks.

Eventual close below 1.2811 would open way towards targets at 1.2661 (15 Aug low).

Sterling received slight support from selling EURGBP on German political news, with market expectations for modest impact from the UK budget report, as most of report already leaked and signaling that UK finance minister Hammond will use his speech to urge his divide party to push for a Brexit deal, as divorce talks stalled.

BoE MPC meeting, due later this week is coming in focus, with wide expectations that central bank will keep the policy unchanged.

Res: 1.2843; 1.2867; 1.2904; 1.2921

Sup: 1.2811; 1.2776; 1.2729; 1.2697