Aussie maintains positive tone but key Fibo barrier still holds; RBA and US elections in focus

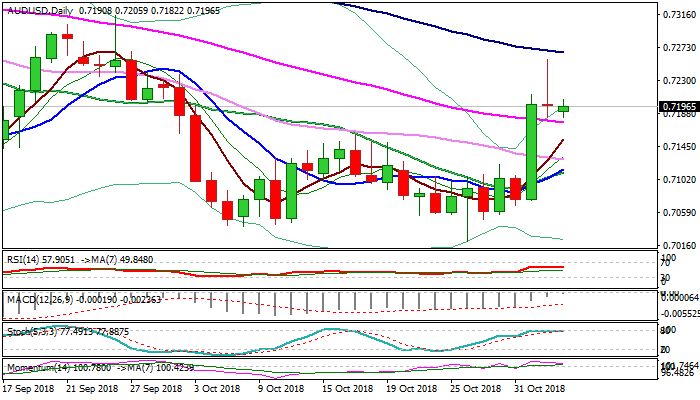

The Australian dollar remains constructive on Monday and attacks again key Fibo barrier at 0.7202 (Fibo 61.8% of 0.7314/0.7020) after two consecutive attempts last week failed to close above.

Friday’s spike to 0.7258 (the highest since 27 Sep) was short-lived as subsequent quick pullback lest daily Doji candle with very long upper shadow, but negative signal from this had so far little impact on bulls, as last Thursday’s massive bullish daily candle continues to underpin.

Bulls need close above 0.7202 pivot to generate bullish signal, with penetration of daily cloud (base lays at 0.7226) and extension above falling 100SMA (0.7267) to confirm bullish scenario.

On the other side, weakening momentum and neutral daily RSI / slow stochastic, warn that bulls may run out of steam, with repeated close below 0.7202 to add to negative signals.

Broken falling 55SMA (0.7176) marks pivotal support, loss of which would weaken near-term structure, while extension below 0.7128 (broken 30SMA) would confirm reversal.

The pair may hold in extended directionless mode and awaiting firmer signals from key events- RBA rate decision and US midterm elections tomorrow.

Res: 0.7202; 0.7226; 0.7258; 0.7267

Sup: 0.7176; 0.7154; 0.7128; 0.7110