Further rise in inflation could undermine lira’s bulls

The US dollar trades slightly higher against Turkish lira on Monday, as disappointing results of Turkey’s Oct inflation raise concerns.

The lira advanced strongly after CBRT’s massive rate hike in September, gaining nearly 10% against its US counterpart, regaining confidence of traders after it hit all-time low at 7.1074.

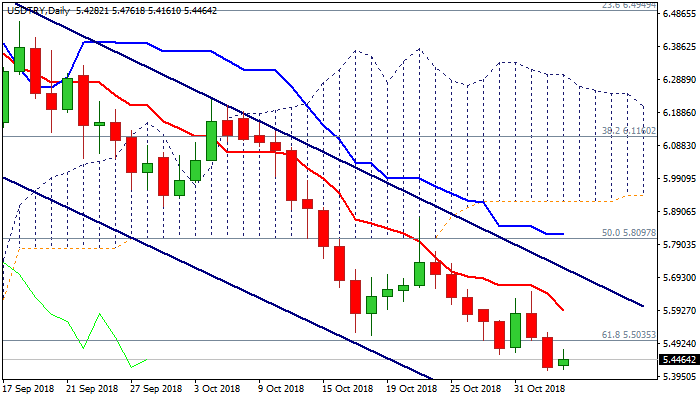

Strong bullish signal for lira was generated on last Friday’s break and close well below key points at 5.5035 and 5.50 (Fibo 61.8% of 4.5121/7.1074 / psychological), as lira hit the highest level in three months at 5.4124 on Friday.

Turkey CPI data released today, disappointed markets, as inflation rose 2.67% on monthly basis, overshooting forecast for 2.0% rise and annualized figure hit 25.24% (the highest in fifteen years), coming well above expectations at 24.5%.

Inflation rose despite lira being on positive path and significant fall in oil prices, with negative impact on emerging markets seen from weaker China’s economy.

CPI miss could have negative impact on lira’s recent bulls, which could be helped by oversold daily techs, with initial basing signal to be expected on sustained break back above 5.50, for swing towards 5.59 zone (100SMA), next pivotal point

Res: 5.4761; 5.5035; 5.5653; 5.5960

Sup: 5.4124; 5.3000; 5.2689; 5.1800