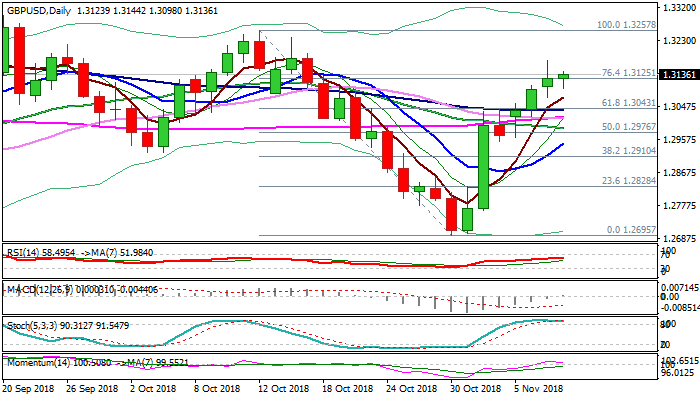

Pound maintains positive tone but overbought techs warn on consolidative / corrective action

British pound is consolidating under new three-week high at 1.3174 in early Thursday’s trading, with bulls show initial signs of fatigue.

Strong upside rejection on Wednesday, overbought slow stochastic and south-turning momentum warn of consolidative / corrective action, however, strong bullish sentiment on Brexit optimism, weaker dollar and overall bullish daily techs, keep near-term bias with bulls.

This suggests that consolidation might be limited before attack at immediate barrier at 1.3187 (falling 30WMA), break of which would open way towards key barriers at 1.3257 (12 Oct high) and 1.3297 (20 Sep peak).

On the other side, extended corrective dips should be contained by daily cloud top (1.3055) to keep near-term bulls intact.

Focus turns to Fed rate decision due later today, which could affect pound’s bulls if US central bank keeps hawkish stance.

The Federal Reserve has raised interest rates three times this year and signaled another hike in December, as strong growth, tight labor market and inflation picking up, support scenario.

Traders also focus a batch of data from the UK on Friday, with highlight on Q3 GDP, industrial production and trade balance, which could provide fresh signals

Res: 1.3144; 1.3174; 1.3187; 1.3235

Sup: 1.3125; 1.3098; 1.3055; 1.3036