Double upside rejection and fears of tariff hike weigh on Australian dollar

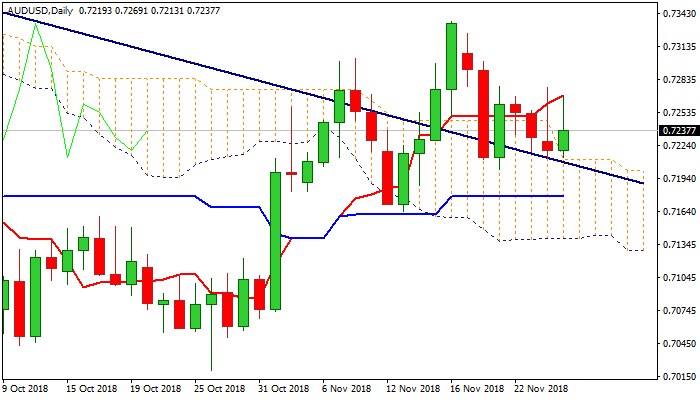

Bounce in to 0.7269 early European trading was short-lived and the pair returned to familiar levels, holding just above top of thick daily cloud (0.7211).

Repeated strong upside rejection adds fears of extension of bear-leg from 0.7335, as the US dollar was boosted by recent comments from President Trump on proceeding with tariff hikes on imports from China.

Daily techs are mixed and so far lack firmer direction signal.

Negative signal could be expected on repeated close below rising 20SMA (0.7230), which needs confirmation on break below nearby pivots at 0.7215 (Fibo 38.2% of 0.7020/0.7335) and 0.7202 (21 Nov trough.

Conversely, lift and close above Mon/Tue spikes at 0.7276/69 would neutralize downside threats and shift focus higher.

Res: 0.7254; 0.7269; 0.7276; 0.7300

Sup: 0.7230; 0.7215; 0.7202; 0.7183