The dollar remains in free fall after short-lived and limited positive impact from Fed

The pair extends steep fall into fifth straight day and was down nearly 0.7% in early Thursday’s trading, following little benefit for the dollar on more hawkish than expected Fed on Wednesday.

The greenback came under fresh pressure after brief post-Fed pause on growing risk-off mode on heightening global risks and decision from BoJ to keep ultra-low interest rates, but showed readiness to boost its massive stimulus program if the situation deteriorates.

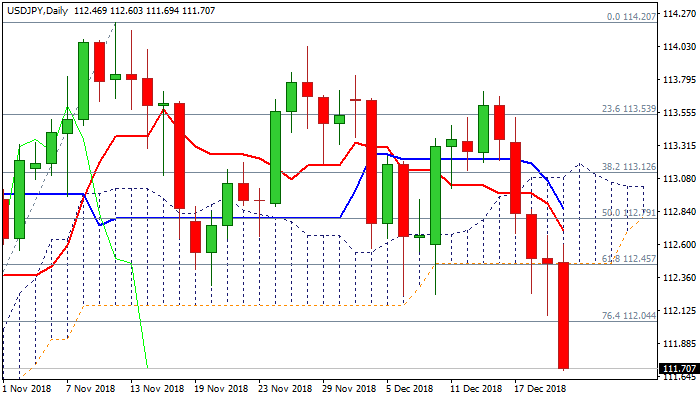

Dollar’s free fall took out the last obstacle at 112.04 (Fibo 76.4% of 111.37/114.20 rally) following eventual clear break below key 112.46 support (daily cloud base / Fibo 61.8%) after two previous attempts failed.

Bears eye key short-term support at 111.37 (26 Oct trough), violation of which would unmask another pivotal support at 110.76 (Fibo 38.2% of larger 104.63/114.54 ascend).

Bearish daily techs support, however, oversold conditions warn that bears may take a breather on approach to 111.37 target.

Dollar-negative sentiment keeps bears firmly in play, with limited corrective upticks expected to offer better opportunities for re-entering downtrend.

Broken Fibo 76.4% support and Wednesday’s spike low mark initial resistances at 112.04/08 and guard key barrier – daily cloud base (112.46).

Res: 112.04; 112.24; 112.46; 112.60

Sup: 111.62; 111.37; 110.76; 110.00